Creating a Shopify based dropshipping business is a fun experience but tax time is not fun at all. This guide demystifies all that you need to learn concerning Shopify dropshipping taxes in 2024. Find out what are the rules governing sales taxes, how to avoid pitfalls, and continue operations efficiently. So you can focus on what matters most: To help you start building your dropshipping empire!

Part 1: What is Shopify Dropshipping Tax?

Shopify dropshipping tax is the tax law that any dropshipper should be aware of when starting their dropshipping companies on this platform. There’re two key concepts: states that have sale tax and nexus that you should be aware of.

Part 2: What Types of Taxes You Need to Pay When Dropshipping on Shopify?

There are two main types of taxes you’ll encounter when dropshipping on Shopify:

Sales tax is a form of state revenue that some states use to fund the provision of goods and services that are sold in their region. In fact, it is just a certain percentage which is added to the total amount which the buyer/buyers are suppose to pay. While acting as a dropshipper, always remember that you are the seller, even if you never come into direct contact with the product. This means you could be required to gather and pay taxes on the sales you make to the right state.

Nexus is a term used in legal contexts that means the affiliation of a business with a specific state. This connection decides whether you are bound to collect the sale tax in a particular state. There are several ways a dropshipping business can establish nexus:There are several ways a dropshipping business can establish nexus:

- Physical presence: Merely having a place of business such as an office, a warehouse, or any other establishment in a certain state may lead to nexus.

- Inventory storage: If you have inventory located in a state, even if through a fulfillment center, you could have nexus.

- Sales volume thresholds: Many states have economic nexus statutes where economic activity (e. g., number of transactions or total sales) exceeding a certain level can create nexus regardless of actual physical connection with the state.

Another form of taxation that you will be subjected to is the federal income tax while you will be required to pay self-employment tax. This includes taxes for Social Security and Medicare that a typical employer would be expected to make for a regular employee.

Summary of Shopify dropshipping taxes:

| Tax Type | Description | When You Pay |

| Sales Tax | Tax on the sale of goods (varies by state) | Collected from customers, remitted to state government |

| Income Tax | Tax on your business profits | Paid on your personal tax return |

| Self-Employment Tax | Covers Social Security & Medicare (for sole proprietors) | Paid with your income tax |

Part 3: Tax Implications for Shopify Dropshippers: Who Pays and What to Expect

The idea of Shopify dropshipping business is perfect for anyone who wants to make their entrepreneurial dreams come true. Struggling with the excitement of sales is the burden of taxes that follows.

The duty to collect sales tax lies with the seller, or in this case, you, the Shopify dropshipper. This is true even if you may not actually touch the inventory, you simply use it as a tool for your business. Here’s the catch: that largely depends on your nexus in the customer’s state. Nexus means that you have some type of connection with a specific state for example through having an office or a warehouse there or you make enough sales that you meet the thresholds.

- If you have nexus in your customer’s state, then, you are mandated to collect sales tax at the right rate and deposit it to the state.

- This is the scenario where you do not have nexus in the customer’s state but your supplier does, they may require you to pay the sales tax upfront or complete a resale certificate (documentation that would indicate that you are going to sell the products with the tax later).

- If you have no nexus in the customer’s state and your supplier also has no nexus there, then you are not required to charge sales tax. Still, the customer might be charged use tax for the use of the product within the state they live in own their own.

Part 4: Shopify Dropshipping Taxes for Dropshippers

In this part, we will take a look at the Shopify dropshipping taxes in each region. Each region may have quite the same regulations on taxes for Shopify dropshipping, let’s take a deeper look:

1. Shopify Dropshipping Taxes in Europe

If you’re new to Shopify, you must decide whether to charge tax before you begin selling. It may be necessary for you to register with multiple VAT member nations. Next, in order to make sure that you charge the correct rates wherever you sell in the European Union, you can set up your taxes in Shopify.

— EU taxes in Shopify

You must decide if taxes are appropriate to charge. If you’re unsure, speak with a tax expert or the local tax authorities. Generally, in order to charge VAT on goods you intend to sell to other EU nations, you must register with your home country’s tax authorities.

You may need to register for the One-Stop Shop (OSS) program or get in touch with each of the necessary authorities to register if your sales into another EU country above a specific threshold or if you have a sizable commercial presence there. The procedure differs according on the location of your company, the markets in which you operate, and the particular laws that apply. The rates you charge your consumers depend on where you are registered to collect VAT.

- Your local VAT rate is applied to customers in your country of residence.

- The fee for consumers in EU countries other than your own is based on whether or not you surpass the 10,000 EUR registration level.

- Your local VAT rate is applied if you don’t go over the threshold.

- The VAT rate of the nation where your customer is located will be applied if you above the threshold. You must register for a VAT number with either OSS or the destination country in order to charge the VAT rate of that country.

In order to find out if you must register in order to collect taxes in a country where you have a substantial presence, get in touch with that nation’s tax office. It is your duty to ascertain whether your company’s sales are too far away to be considered distant.

— Charge VAT with the OSS

The Union OSS, also known as the One-Stop Shop plan, is designed for EU-based retailers who sell to other EU members and must charge and remit VAT according to the destination nations. Due to Northern Ireland’s dual status, the OSS is also available to businesses that have locations there.

You can either register for the OSS if you wish to charge VAT based on the location of your customers, or use the micro-business exemption to charge your local VAT rate if your annual sales to all other EU member nations are less than 10,000 EUR.

Only stores that use registration-based taxes are eligible to use OSS. Use location-based tax rates to manually change your tax rates if you haven’t adjusted your settings to use registration-based taxes.

2. Shopify Dropshipping Taxes in the US

You must ascertain your tax liability—that is, if you must collect tax from your clients and send it to the appropriate state tax authority—before you can set up your US taxes.

For instance, if you are a merchant based in the United States, you can be taxed in your country or state of residence because of contact point. Even if a business is not physically in a state, they may also be subjected to taxation in that state if they frequently deliver goods to customers in that state as a result of economic nexus.

The sales tax you should impose in the US depends on a number of factors, including:

- The address from which your product is mailed

- The address where your product is shipped and where you have set up your tax collection account

- Taxability of Items

- Exemptions for buyers

— Tax Regulations for Dropshippers in US

If you use dropshipping in your store to supply products to clients, you are purchasing a product from a different vendor, and your customers are purchasing that product from you. The location of your customer and the area in which you and your dropshipping vendor are connected will determine whether or not you charge tax. Examine the following situations and choose the one that most closely resembles your company:

- You are not required to charge tax if neither you nor your dropshipping supplier have any connections to the state where your consumer resides. It is probable that your client will have to pay a use tax to the state where the purchase is made.

- Your dropshipping vendor may request a resale certificate from you or charge you the relevant tax if you do not have any nexus in the state where your customer resides.

- You must charge tax to your customer if you have nexus in the state of your customer but your dropshipping vendor does not.

- If you and your dropshipping vendor are both based in the same state as your customer, your vendor may request a resale certificate from you or charge you the applicable tax, and you will be responsible for passing along the tax to your consumer.

Should you be uncertain about your obligations in a particular state, get advice from state tax officials or a local tax expert.

— Register for Taxes

You can register with the state tax authorities once you’ve decided where in the US you need to charge tax. Each state has a distinct authority to contact, and there may be variations in the registration process. Contact details for tax authorities are listed by state in the state tax reference table.

3. Shopify Dropshipping Taxes in the UK

You must decide if taxes are appropriate to charge. If you’re unsure, speak with a tax expert or the local tax authorities. If you are based in the UK and your sales to clients there total 85,000 GBP or more in a calendar year, you usually have to register for VAT.

In the event that you intend to sell to an EU member state after Brexit, you might need to register with their tax authorities. The process varies depending on where your business is located, the markets you serve, and the specific laws that are in effect. Determining where you need to register in order to charge VAT is your responsibility.

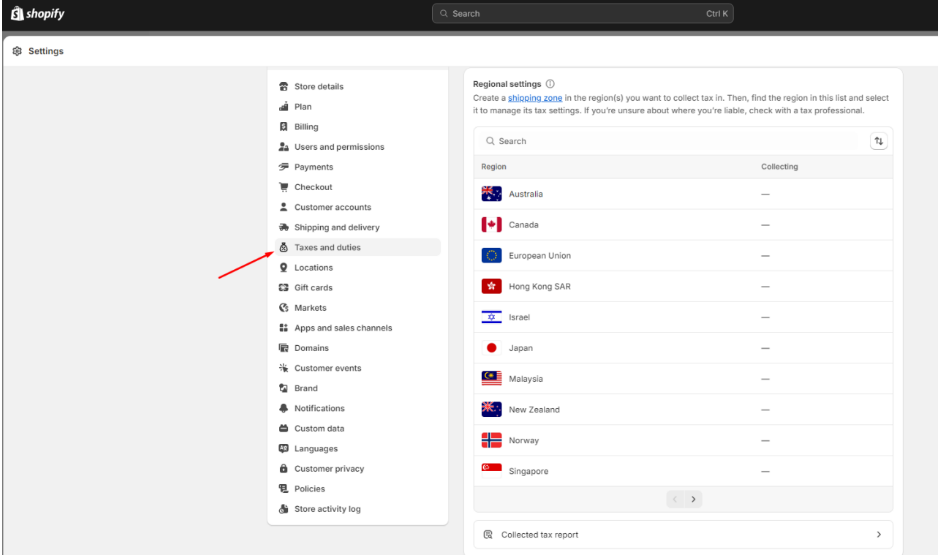

Part 5: How to Set up Shopify Dropshipping Taxes?

After understanding the basic things about the Shopify dropshipping taxes, you will need to set up the tax rates on your own dropshipping stores to make sure your stores have all legibility.

1. Set up location-based tax rates

You must charge sales tax at the rate specified in the area where your goods is delivered because many countries base their taxation policies on the destination of an order. See a tax professional if you have any questions concerning these specifics.

Make sure your product is taxable and that you are not required to charge sales taxes to your clients before setting up taxes depending on destination. Additionally, make sure you have established a shipping zone for the destination country and that your store address is not located in an area where registration-based taxes are applicable.

- Navigate to Settings > Taxes and duties from within your Shopify admin.

- Click the nation’s name in the Tax regions section.

- Enter the applicable rates for the nation and any regions in the Base taxes section. You have the option of having a regional tax applied in lieu of, in addition to, or compounded with a federal tax. Get in touch with your tax authority or a local tax professional if you’re unsure which choice to select.

- Press Save.

2. Set up taxes in product prices

In many nations, including the UK, sales tax must be included in the prices that are advertised for the majority of product categories.

- Navigate to Settings > Taxes and duties from within your Shopify admin.

- Choose to include the shipping cost and product price with sales tax.

- Press Save.

- Not required: Use the following to apply your customer’s local tax rate:

- Navigate to Settings > Markets from your Shopify admin.

- Press the Preferences button in the Other markets section.

- Depending on the nation of your customer, choose Include or exclude tax.

- Press Save.

3. Set up taxes on shipping rates

You must impose shipping taxes in some areas. To add taxes to your shipping costs if your store is located outside of Canada, the US, the EU, Norway, Switzerland, the UK, Australia, or New Zealand, simply follow the instructions below.

- Navigate to Settings > Taxes and duties from within your Shopify admin.

- Verify the shipping rates’ tax charges.

- Press Save.

Part 6: Shopify Dropshipping Tax FAQs

Q1: Does Shopify charge sales tax?

Sales tax is not automatically charged to you by Shopify. Nonetheless, you have two options for handling it: either use Shopify Tax or combine a tax application with your online store and modify Shopify’s configurations so that every qualified transaction adds the appropriate sales tax rate at the point of sale.

Q2: Does Shopify supply me with tax reports?

You can obtain a sales finance report and a tax finance report from Shopify. To assist you with tax reporting and filing, these provide a summary of your financial information.

Q3: Does Shopify charge VAT?

You should research the sales tax and VAT laws of every nation you do business with, especially the UK and Europe. Tax applications will assist you in determining the appropriate amounts to charge and remit, and they will each have their own thresholds.

Final Words

Congratulations! This marks the end of your brief tutorial on Shopify dropshipping taxes in the year 2024. Taxes are often not something that would make people jump with joy when it comes to managing their business, yet, when you know how it works, you are confident. So always ensure to keep an update with the sales tax, nexus, and your income taxes so that your dropshipping business will not have a bumpy ride.

![Dropshipping General Store vs. Niche Store [2025 Data and Table]](https://www.dropshipman.com/wp-content/uploads/2025/03/general-vs-niche-store.png)